It’s six months now since the bedroom tax hit Scotland’s social housing tenants and as its full impact becomes clearer by the day, sadly, it’s living up to the worst of expectations.

The cold statistics of 82,500 families/households being affected and estimates of 40% of them running up arrears don’t really communicate what it’s like to suddenly lose up to a quarter of your rent for a home you may not have had much choice over when it was allocated.

Press headlines highlight individual stories and, sadly all too often, personal tragedies, but these are the tip of the iceberg and don’t truly reflect the day-to-day nightmare faced by struggling tenants who we and other organisations offering housing advice and support increasingly have to help.

There are plenty of campaigns – calls to scrap the tax and accusations of blame from politicians, former politicians, would be and want to be again politicians. That’s fine. You can’t stop politicians from being political. For the record, we think it should be scrapped too. But we also think all of Scotland’s politicians should take responsibility – lead from the front and not just call on someone else to do something. The UK Government, the Scottish Government, MSPs and local councillors – together with landlords and tenants – need to do what they can to help now.

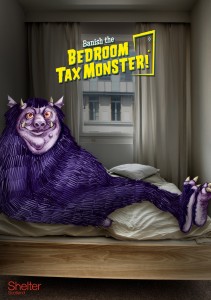

That’s why today Shelter Scotland has launched our Banish the Bedroom Tax Monster Campaign and why we’ve put in place a six-point action plan calling on the Scottish Government to provide an essential lifeline to households affected by the bedroom tax and to help prepare for future welfare reforms.

“The bedroom tax looms large in the lives of those affected. For many it is like a monster living in their home.”

Our plan:

- 1. Homeless people with no option other than temporary accommodation should be exempt from the bedroom tax.

- 2. Discretionary housing payments should be easier to access and should help more people.

- 3. Tenants with rent arrears should not be blocked from downsizing into more affordable properties

- 4. Build more social housing to cut the benefit bill for the long term

- 5. Everyone affected by benefit changes like the bedroom tax and upcoming Universal Credit can access free, independent advice and advocacy

- 6. Where possible, tenants should always pay their rent including any shortfall incurred through a bedroom tax deduction.

Blogs sometimes have a witty or wry ending. This doesn’t, so sorry to disappoint. It’s all a bit too serious for that. But we do think that you should visit our Banish the Bedroom Tax Monster Campaign; support our call to get politicians behind our action plan and tell Ministers in the Scottish and UK Governments to do what they can to help now. Please.